Blogging is fast becoming a business in its own right. I know a couple of guys who have been running their own networks of nearly half a dozen blogs and treating it as a full-fledge business. The fact is that if you are good at keyword selection, writing, Internet marketing, and monetizing, blogging can very well be a money spinning activity that you can carry out from your home, but it is not necessary. There’s a guy who started from a blog on soccer and the site has grown up to a point that he had to rent an office to accommodate the staff working on that blog which has now moved on to become a community.

To cut a long story short, if you are blogging full time and earning substantial income, you might want to know about the possible tax deductions that you can claim while earning money via blogging. Do remember that the validity of the following deductions might differ from one case to another, so you must consult with a professional accountant or tax expert before applying.

The Workplace:

Doesn’t matter if you are working from home or a small rented office, chances are that you can ask for it to be regarded as a tax deduction. It might get a little tricky if you are blogging from home on a laptop, because in order to be able to claim tax deduction for your home based office, you will need to have a separate room or workplace, which is used entirely for work purpose. If you are blogging on your laptop from your lounge, that doesn’t really fall under the category of home office, for obvious reasons.

The Equipment:

Everything you purchase exclusively for the work purposes, for example a writing desk, chair and table, even the routine office supplies, are all deductable, as long as you are keeping a good record along with the receipts. Even the stuff that you will purchase as a source for your research, for the material you are about to put on your blog or website, can turn out to be a possible deduction.

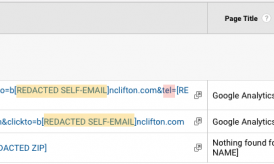

Online Expenses:

You can start and maintain a personal blog on a blogging platform without spending a single penny. However, when you are looking to earn substantial income via blogging, you will need to invest quite some bucks on your blogs. Starting from acquiring a domain name to web hosting, web designing charges, or the fees of some SEO professional (if you have hired any), the payment to writers or any other kind of assistants, and the likes. All of these are business expenses and you can claim them as tax deductions.

There are many other possible deductions as well, but the aforementioned ones are easily the most common ones, and they might apply on a majority of full time bloggers. However, you must get in touch with a professional accountant or tax expert, because the rules and regulations might vary in different countries.

This all is quite natural, because everywhere in our life if we want to to get excellent and fruitful results in any kind of business, then we should spend some money on it from the very beginning

As a blogger you need three things to be successful.

1) Passion to write interlining stuff about your topic.

2) Hard Work and Discipline (Most Bloggers start passionately,but leave it midway due to laziness)

3) Patience (Most important thing if you want to be a successful blogger or in online business)

I agree with your points about hard work. Blogging is a job, hard, long-term but rewarding in the end.

With online expenses and equipment it is clear, I have a tax deduction for hosting. But as documented room in the house I absolutely can not imagine.